I was fortunate to be mentored by some of the best journalists and editors in finance at Barron’s magazine.

There I learned…

- The arc of a compelling story

- How to delight readers through even the most mundane of topics; and

- The common pitfalls to avoid in order to prevent audience boredom

I believe that storytelling is essential to building a successful brand. Below are links to five of my favorite stories – and a non-exhaustive list of other stories – that illustrate my ability to craft compelling narratives.

(Under Marketing Strategy, you can find how I’ve applied my skills as a journalist to results-driven, brand-building.)

MY FAVORITE STORIES

Schwarzman’s Scholars

“Stephen Schwarzman, the famously detail-oriented CEO and co-founder of the Blackstone Group, has placed a big bet on education — and America’s relationship with China. In April, he announced a $100 million gift to create a scholarship fund… and pledged to raise a further $200 million to help fund the scholarship’s endowment.” READ MORE

The Sweet Smell of Euro Trash

“Europe will be the hot equity play of 2014, claims JPMorgan Private Bank. If you are of a similar view, we have a less obvious way you might play the turgid European recovery—distressed debt. Large tranches of nonperforming European loans, priced at 30 to 50 cents on the dollar, are about to come onto the market.” READ MORE

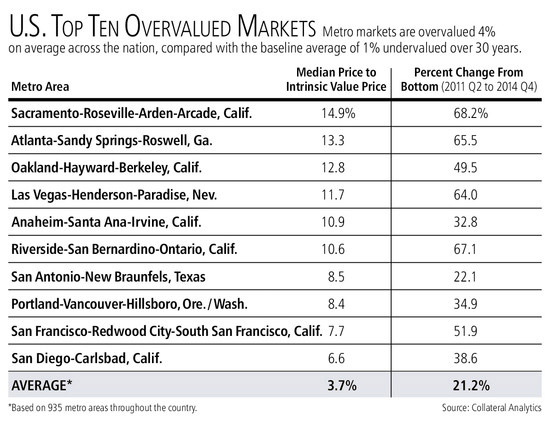

Real Estate: Top 10 Most Overvalued Cities

“Intent on buying an elegant Arts and Crafts home in Berkeley, Calif.? How about a bachelor pad in playground Las Vegas? Think again. Such markets show signs of overheating.” READ MORE

The $100000 Hedge Fund Slice

“Families with a $5 million portfolio can now diversify with hedge funds and alternative investments that were previously beyond reach, due to minimum investments of $1 million to $10 million. Technology-driven start-ups are now chopping down those hefty commitments into $100,000 slices, and then efficiently making these more digestible bites available on a Web-based platform.” READ MORE

Impact Investing Done Right

“Impact investing—the art of creating portfolios that earn market-rate returns while also seeking to advance social or environmental aims—is a mercurial child of the 21st century. Hard to pin down with precise definitions and interpreted in a variety of ways, impact investing is nonetheless a fast-growing force below the surface of our financial markets, effectively blurring the lines between philanthropy and investing.” READ MORE

A quick note on why crafting an effective narrative is so important…

Academics have studied the power of storytelling.

Here are three surprising findings:

People would rather administer electric shock to themselves than be bored.

Audiences retain more information for longer when they enjoy receiving it.

Stories boost memory sevenfold, improving learning & information recall.

MORE STORIES

This is a non-exhaustive list of Barron’s magazine and Barrons.com articles published between 2010 and 2015.

- The Charitable Tax Fallout

Description: Atlas of Giving discusses how changes to the charitable tax code will impact philanthropy. - Family Foundations Find Their Footing

Description: Family foundations with $1M to $10M assets made a significant impact in 2012. - How to Get 5.5% a Year for the Next Five Years

Description: Deutsche Asset & Wealth Management offers strategies to benefit from U.S. real estate. - Real Estate: Five Cities Expected to Outperform

Description: Emerging second-tier real estate markets are expected to show strong growth in 2015. - Who Will Succeed the Vintage Vintners?

Description: California wine families are navigating leadership transitions amid the industry’s future challenges. - Saving Golf Clubs

Description: Younger players and private jets are reshaping the golf industry, with remodeling and new courses. - Private Equity Courts The Well-to-Do | Penta

Description: Blackstone Group targets wealthy individuals for private equity investments to diversify their portfolios. - A Family-Office Co-Op | Penta

Description: The Corning family’s multifamily office model appeals to wealthy families seeking shared services. - Where the Rich Park Wealth | Penta

Description: Study shows the top 1% hold a significant portion of wealth in closely-held businesses. - From Pollock to Rothko, How to Spot a Fake

Description: Art forgery expert offers tips for collectors to avoid purchasing counterfeit artworks. - The Family Portrait

Description: Tina Barney’s iconic photograph captures the quiet bond between a father and daughter. - Art Auctions Head Online

Description: Sotheby’s faces pressure to develop its online auction platform in the wake of activist calls. - The $800 Million Club

Description: Wealthy families demand sophisticated tech platforms to track their global assets and investments. - The “Mid-Caps” of Art

Description: Chad Loweth sees potential in art pieces valued between $30,000 and $75,000. - Marriage of Convenience: CIBC Eyes U.S. with Atlantic Trust

Description: Canadian Imperial Bank of Commerce expands its wealth management with the purchase of Atlantic Trust. - Art Advisors: Are They Worth It?

Description: An in-depth look at the growing industry of art advisors for both new and seasoned collectors. - Mr. Freud in the Family Office

Description: Matter Family Office offers psychoanalysis to manage complex family dynamics in wealth management. - High Life, High Fees

Description: Wealthy clients opt for turnkey luxury villas with hotel services to avoid estate management burdens. - Silvercrest’s Silver Lining | Penta

Description: Silvercrest’s assets grew 48% annually since 2002, with equity funds outperforming benchmarks. - Social-Impact Investments Finally Grow Up | Penta

Description: Socially responsible investing now represents $6.6 trillion, reflecting a shift towards impact-driven portfolios. - Investing With Your Heart | Penta

Description: A charitable account platform offers impact-investment opportunities with fees under 1% annually. - U.S.’s First Impact Bond A Bust | Penta

Description: A $7.2 million bond aimed to reduce recidivism at Rikers Island fails to meet its goals. - How Impact Philanthropy is Shape-Shifting | Penta

Description: Exponent Philanthropy reveals a shift toward more impactful, larger donations from foundations. - A Novel Way to Finance Social Good | Penta

Description: Social-impact bonds offer an opportunity to fund social causes with potential for profit. - Contact Fund: Profitably Lending Money to Charities | Penta

Description: The Contact Fund offers private investors market-rate returns by lending to New York City nonprofits. - Art Advisors: Are They Worth It? | Penta

Description: Art advisors help clients find and purchase artworks, charging a commission or hourly fees. - Art Law Rising | Penta

Description: Lawyers enter the art market, addressing ownership, copyright, and authenticity disputes. - Booming Art Market Paints a Picture of High Risk | Penta

Description: The art market’s growth signals a potential bubble, warning collectors of rising risks. - The Hedge Funds of the Art World | Penta

Description: Art funds manage important collections, mirroring the traditional strategies of wealthy collectors. - Pulse of the Rich | Penta

Description: Wealthy investors remain confident, with U.S. stocks continuing to rise and retirees staying active. - Anatomy of a Billionaire | Penta

Description: A study on billionaires predicts a new era of philanthropy, passing trillions in wealth. - Overpaying for Financial Advice | Penta

Description: A survey reveals 13% of decamillionaires are overpaying for financial advisory services. - Wells Fargo Unit Banks on Family History

Description: Abbot Downing focuses on wealthy clients’ family histories, enhancing their wealth management experience. - U.S. Trust: Winning Back Clients | Penta

Description: U.S. Trust rebrands to combine personalized service with the capabilities of a large bank. - New Money Is Heading to Brown Brothers Harriman | Penta

Description: Brown Brothers Harriman sees growth through private equity and lending arms, gaining new clients. - Private Equity: Beware of Zombie Funds | Penta

Description: Zombie funds invested during peak valuations before the market downturn, leaving investors vulnerable. - Wells Fargo Private Bank Woos Small-Business Owners

Description: Wells Fargo Private Bank offers tailored services to small-business owners, enhancing both personal and business wealth. - Hedge-Fund Headaches | Penta

Description: Hedge funds underperform the market, with losses outpacing the S&P in the past year. - Hedge Funds Head South | Penta

Description: Family offices expect hedge funds to deliver 10% returns, while managers predict lower gains. - How the Superrich Hedge Their Bets | Penta

Description: The superrich hedge their wealth through a range of strategies, diversifying beyond traditional investments. - The $800 Million Club | Penta

Description: Wealthy families turn to private equity to diversify, with Northern Trust recommending 50% asset allocation. - Invest Like a Billionaire | Penta

Description: Wealthy families invest directly in private companies for hands-on control and higher returns. - Citi: Private Equity And Real Estate Top Picks | Penta

Description: Citi Private Bank predicts private equity and real estate will outperform stocks, with 12% annual returns. - Billionaires Invest Differently | Penta

Description: Billionaires focus on alternative investments, moving away from traditional stocks and bonds. - Students Try Social-Impact Investing | Penta

Description: University of Utah students gain practical experience in the growing field of social-impact investing. - Congress Targets Charitable Giving Accounts | Penta

Description: Congress scrutinizes the rise of donor-advised funds as charitable giving reaches record levels. - Legacy Venture, Silicon Valley’s VC Fund for Charities

Description: Legacy Venture’s successful VC investments in Facebook and other startups boost its charitable initiatives. - The Charitable Tax Fallout | Penta

Description: Atlas of Giving predicts the impact of charitable tax code changes on philanthropy and giving. - Philanthropy: A Surprising Rise in Giving

Description: Atlas of Giving revises its forecast for 2015, predicting a rise in charitable donations. - The Tax Hike Silver Lining | Penta

Description: Higher taxes and market growth drive significant increases in donations to donor-advised funds. - Family Foundations: Back in Financial Order | Penta

Description: Small and medium-sized family foundations rebuild their financial reserves, improving charitable giving outlook. - Philanthropic Fiascos | Penta

Description: Common mistakes in philanthropy explored, offering lessons for more effective charitable endeavors. - The Philanthropic Defense

Description: Tiger 21 members refine their charitable giving strategies, becoming more sophisticated in their approach. - Estate Planning for Modern Families | Penta

Description: Effective estate planning for modern families involves balancing diverse assets and blended family dynamics. - Wealth Trends to Watch | Penta

Description: A UBS survey reveals that modern families are increasingly common among high-net-worth individuals. - Common-Law Spouse | Penta

Description: Estate planning for common-law spouses helps avoid legal battles over inheritance rights. - Family Business Woes | Penta

Description: Family businesses face financial optimism but struggle with succession planning for the next generation. - Navigating Complicated “Directed Trusts” | Penta

Description: Directed trusts provide wealthy families with tailored asset management solutions for complex estates. - IRS Considers New Tax Rules for Art | Penta

Description: The IRS weighs potential tax reforms targeting art collection ownership and resale profits. - IRS Considers New Tax on Wealthy Families | Penta

Description: The Treasury Department considers implementing a new tax that could impact wealth transfer strategies and estate planning for wealthy families. - Report Card on Globe’s Private Banks | Penta

Description: A detailed analysis of the world’s largest private banks, controlling nearly $21 trillion in assets for wealthy clients, highlighting performance and growth. - Behavioral Finance in the Private Bank | Penta

Description: How private bankers use behavioral finance to help clients make smarter investment decisions and avoid panic during market downturns. - Thompson’s Turnaround at SunTrust’s Private Bank | Penta

Description: SunTrust’s private bank sees steady growth in assets under management after a leadership turnaround led by Thompson, focusing on client relationships and tailored services. - Invest Like Yale | Penta

Description: A comparison of Yale’s endowment strategy, which heavily invests in alternatives, offering insight into how high-net-worth individuals can replicate this approach. - The Case for a Globally Diversified Portfolio | Penta

Description: A former private banker explains the benefits of a globally diversified portfolio for wealthy investors seeking growth beyond domestic markets. - Business Owners Rethink Legacy | Penta

Description: Business owners are reevaluating their legacies, shifting from traditional wealth transfer models to more dynamic approaches that include charitable endeavors and new family structures. - Head of U.S. Bank Aims to Beat Rivals in the Wealth Game | Penta

Description: The head of U.S. Bank outlines strategies to surpass competitors in the wealth management space by focusing on personalized services and innovation. - Veritable Offers Up the Unvarnished Truth About Client Reporting | Penta

Description: Veritable, a wealth manager for America’s richest families, offers a transparent after-tax client reporting system that helps clients make better investment decisions. - Buy Pan-Asia Stocks on the Dips | Penta

Description: Veritable recommends buying emerging market stocks in Asia during market dips, leveraging a curated list of top-performing money managers. - How to Buy Hot IPOs | Penta

Description: A guide for wealthy investors on how to gain access to highly anticipated IPOs, such as Alibaba Group, and capitalize on early-stage investment opportunities. - Eric Clapton’s Watchmaker | Penta

Description: The story behind the $3.6 million watch once owned by Eric Clapton, which has appreciated 14 times its original value since its production in 1989. - ‘Pay for Success Bonds’ Drum Up Interest | Penta

Description: “Pay for Success” bonds attract investors looking to fund social programs with a financial incentive tied to the success of reducing recidivism or other social goals. - Watch Round-up | Penta

Description: A selection of luxury timepieces from Audemars Piguet, F.P. Journe, and Officine Panerai that have captured the attention of watch enthusiasts and investors alike. - Post-Digital Mechanical Watch | Penta

Description: Urwerk’s latest mechanical watch merges traditional craftsmanship with modern technology, showcasing an innovative approach to timekeeping in the post-digital era. - Watchmaker IWC Courts Women | Penta

Description: IWC’s new Portofino Midsize collection targets women with a stylish range of watches designed to blend elegance with precision. - Numbered Days for Chanel and Armani? | Penta

Description: A look at how luxury brands like Chanel and Armani may face challenges in the evolving luxury watch market as consumer tastes change. - 7 Lux Stocks to Buy | Penta

Description: Recommendations for luxury stocks to buy, including shares in companies behind iconic brands like Prada, Swatch, and Tiffany, catering to affluent consumers. - Biggest Givers of 2012 | Penta

Description: A roundup of the largest charitable donations made in 2012, including Carl Icahn’s $150 million donation to Mount Sinai School of Medicine. - How American Century Investments Funds Science | Penta

Description: American Century’s $2 billion donation to science, including a major share of its mutual fund company, highlights the intersection of philanthropy and financial strategy. - Fine Wines, Best Value | Penta

Description: Expert recommendations on the best value wines under $100, including a dry Champagne, savory white, and a robust red Burgundy that offer both quality and affordability. - 9 Top Investment Ideas For Wealthy Investors | Penta

Description: A curated list of top investment ideas for high-net-worth individuals, including insights into the emerging wine market and opportunities in global stock investments. - When Excess Is A Good Sign

Description: A lively event at the $3.5 billion Baha Mar resort highlights exuberance in luxury. - Athletes and Charities

Description: Matt Stover encourages athletes to protect their brand by utilizing donor-advised funds. - The Jazz Behind Treme

Description: A spotlight on the talented New Orleans musicians who appeared in the HBO series “Treme.”