Developing and executing comprehensive marketing strategies that drive measurable business results is my specialty. I excel in mapping customer journeys, managing a marketing calendar and leveraging data insights to align marketing initiatives with overarching business objectives.

Below are a collection of initiatives I worked on that demonstrate my ability to nurture leads through each stage of the marketing funnel, from awareness, consideration, conversion and loyalty using newsletters, eBooks, blog posts, learning management system, brand ads, social media and video script writing.

BRAND CREDIBILITY & ENGAGEMENT

Weekend Reading

Read by more than 100,000 investors every week

This newsletter has proven highly successful at increasing brand credibility in the minds of potential subscribers and, ultimately, driving conversions.

Based on our Customer Persona work, we designed “Weekend Reading” as a longer-form, in-case-you-missed-it-style market newsletter for busy investors. Investors reading “Weekend Reading” are in-the-know about markets.

There is a consistent narrative throughout “Weekend Reading” that drives the reader to take a specific action – watch a video, read a complimentary product we’ve unlocked for you and, of course, subscribe.

A co-worker and I came up with the concept for the “Weekend Reading” newsletter, in 2017, after observing consistently elevated email open rates on the Saturday and Sunday.

STORYTELLING & CUSTOMER ACQUISITION

Master the Market: A Hedge Fund Manager’s Guide to Process & Profit

Doubled weekly prospect acquisition (i.e. email collection).

I co-authored this book with our CEO Keith McCullough. As a former hedge fund manager with about 25 years of Wall Street experience, this book underscored our CEO’s expertise through storytelling. The intent was to generate a compelling “lead magnet” to acquire new subscribers that also strengthened our brand authority.

The book unfolds in a series of stories tracing Keith’s Wall Street career. The focus of these stories is to explain how dramatically Wall Street has changed in the past two decades. Based on these radical changes, investors need to employ new investing tactics to manage their money. Enter Hedgeye.

Investors who download the eBook also received an automated, drip marketing campaign that teaches the lessons learned in each chapter. Each email uses these lessons to promote a product and drive subscriber conversion.

The Firm That Called “The Crash of 2020”

A multi-platform campaign that pushed traffic to Hedgeye.com.

Hedgeye made a significant market call prior to the dramatic COVID-19 selloff in the stock market (and the corresponding economic lock-down).

We took advantage of this opportunity by directing a significant amount of traffic (from X, LinkedIn and Youtube) to this post on Hedgeye.com.

The post uses storytelling to insert Hedgeye in to the dialogue about the Covid-19 selloff:

“There’s a revolution underway on Wall Street. A former Yale hockey player from (of all places) Thunder Bay, Ontario and his team of former buyside analysts are dispelling the tired notion, ‘You can’t time markets.’

The macroeconomy wiggles and waggles in predictable patterns they say. Diligently measuring and mapping these ups and downs can help you preserve, protect and grow your portfolio.

Sound crazy? There’s more.

The firm’s outspoken founder, Keith McCullough, has continued to pound the table on another ‘crazy’ idea he’s espoused since the company’s inception in the middle of the 2008 Financial Crisis: “Hedge fund quality research for all investors.”

Enter Hedgeye Risk Management…”

CUSTOMER JOURNEY MAPPING

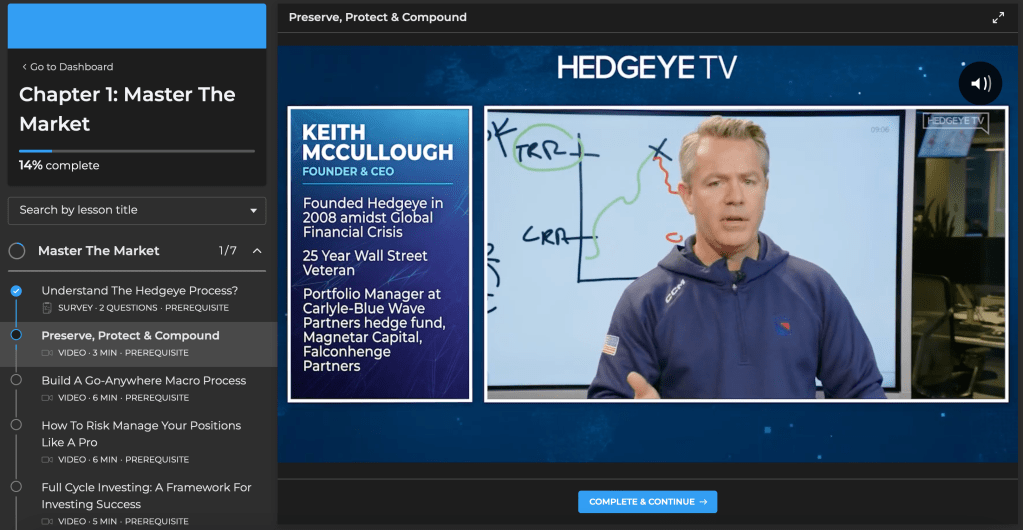

Hedgeye University

Tens of thousands of investors have enrolled in the courses.

Hedgeye’s taglines include:

- “A better way to invest”

- “Hedge fund quality research for all investors”

This sophisticated investing process requires learning a risk management process that runs counter to mainstream Wall Street investing tropes.

Hedgeye University is a core part of the Customer Journey – with an automated email series designed to teach and reinforce lessons learned in Hedgeye University.

Subscribers who completed the first 20-minutes of Hedgeye University reported more satisfaction with Hedgeye and had higher retention rates.

I worked as the project manager for designing the entire “Hedgeye University” curriculum from scratch – writing the scripts, coordinating the filming with our CEO, producing all the copywriting and implemented all design and structure within the Learning Management System.

There are five “lessons” within Hedgeye University, each of which features a series of short 2-5 minutes videos teaching a core investing concept.

BRAND AWARENESS

Nature + Investing Quote + Hedgeye Branding

From 100,000 to 2.5 million views each on X.

These 30-second ads have proven highly impactful on social media.

The purpose of these ads was to increase viral load by giving viewers valuable insight with a quote from one of the world’s smartest investors. The quote was supported by compelling video from nature to boost intrigue (causing viewers to pause upon scrolling to these Hedgeye posts).

We discovered in the process of producing these videos that visibility was maximized when posting them during highly impactful times in the stock market, when volatility is rising and investors are looking for answers.

Social Media: The “Fartcoin” Affair

More than 4.5 million people viewed this post on X.

The “fartcoin” post I wrote is quintessential Hedgeye. Words to describe the “voice of Hedgeye” – the firm’s brand language or identity – include:

- Bold: Unafraid to challenge the status quo or traditional financial narratives.

- Confident: Speaks with authority and conviction, reflecting deep expertise.

- Straightforward: Prioritizes clarity and directness over corporate jargon.

- Edgy: Sharp, sometimes provocative language to captivate and differentiate.

- Data-driven: Demonstrates thought leadership through analytical insights.

- Relatable: Balances financial expertise with an approachable tone.

- Contrarian: An independent, against-the-grain perspective.

The post above checks all these brand language boxes while also being perfect content for a social media platform like X, where concise, timely, humorous and thought-provoking content shines.

The post went viral because it captured a common feeling of investors at the time, that an absurd mania was gripping financial markets. The size of Fartcoin’s market capitalization relative to publicly-traded companies confirmed these feelings with data. It made them laugh. And we went viral.

The Fourth Turning: Why American Crisis May Last Until 2030

Youtube Views: 641,000

Driving brand awareness creates a competitive edge and generates long-term business growth. Measures of impressions, video views and page views are the first step on the road to subscriber growth.

Author and Hedgeye Demography Sector Head Neil Howe’s work has influenced politicians from Newt Gingrich to Al Gore and all of it culminates in a grand theory advanced in The Fourth Turning. According to Time magazine, President Donald Trump’s influential chief political strategist Steve Bannon was “captivated” by the book.

Featuring Neil’s work throughout Hedgeye.com and other distribution channels was a massive opportunity to drive awareness. I wrote the script and general storyboard for this video featuring Hedgeye Demography Sector Head Neil Howe. In it, Neil describes the generational theory put forth in his 1997 classic “The Fourth Turning,” co-authored with William Strauss.

It was an honor to collaborate with Neil and write this script based on his book “The Fourth Turning.” The results (more than 600k views on Youtube alone) created a measurable business opportunity to acquire new subscribers for Hedgeye.